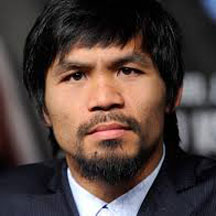

QUEZON CITY (PinoyNews) – Rep. Manny Pacquiao has won the first round against the Bureau of Internal Revenue (BIR) after the Court of Tax Appeals (CTA) ordered the BIR to stop garnishing the boxer’s properties and bank deposits.

The CTA, however, required Pacquiao to make a cash bond for P3.2 billion or a surety bond for that amount which is equivalent to certain portion of the BIR’s tax claims on his earnings.

Court records showed that Pacquiao’s alleged tax deficiences with BIR has ballooned to P4.4 billion from only $2.2 billion last year.

The BIR said Pacquiao misdeclared his income tax returns for 2008 and 2009 as he allegedly failed to report his dollar winnings from his fights against Juan Manuel Marquez, David Diaz, and Oscar de la Hoya in 2008; and Ricky Hatton and Miguel Cotto in 2009.

Pacquiao, however, claimed that he had paid his taxes in the United States in accordance with law, adding that paying again in the Philippines would be tantamount to double taxation.

Pacquiao welcomed the CTA decision, but his lawyer said they will appeal for reduction of the cash or surety bond because the fighter would not be able to raise the required bond.

“Salamat sa ating Pangulo, sa tulong niya at kay Kim Henares,” said Pacquiao.

Upon arrival from Los Angeles, Pacquiao claimed that he owned the BIR nothing because he had paid taxes in the United States and have all the proofs to back up his statement.

As this developed, Pacquiao filed his income tax return in the BIR office in General Santos City and paid P165 million, making him one of the top individual taxpayers, if not number one, in the country.

Pacquiao said that he has been a diligent taxpayer stressing that citizens like him are duty bound to help the government raise the necessary revenues to finance the operations of the government and provide services, infrastructures and other concerns of the people.

The BIR was elated over the ruling of the Court of Tax Appeals (CTA) on the garnishment order against the world boxing champion and Sarangani congressman.

In the CTA ruling, it temporarily stopped the BIR from collecting P2.2 billion from Pacquiao for his alleged tax deficiency for taxable years 2008 and 2009.

BIR Deputy Commissioner Estela Sales said that for the CTA order to take effect in stopping the garnishment against the bank accounts of Pacquiao, it is necessary that he should first post a cash bond equivalent to the amount the BIR is running after him or P4.9 billion surety bond.

The CTA has given Pacquiao a period of 10 days within which to post the bond, failure of which, the suspension order against the garnishment order would not take effect, meaning that, the garnishment order against Pacquiao would proceed.

Sales said the CTA ruling favors the government because it protects the interest of the government.

“So, the court granted their motion to suspend the collection. However, it’s on condition upon the posting of cash bond…we are happy with that decision, because the interest of the government is amply protected,” she said

Sales clarified that the CTA merely resolved the urgent motion to lift garnishment order filed by Pacquiao, adding that the case is not yet terminated because the decision of the CTA on the merit of the case is still pending.

“Accordingly, respondent is hereby ordered to cease and desist from enforcing the subject Final Decision of Disputed Assessment (FDDA) and from collecting the subject deficiency tax assessments issued against petitioners for taxable years 2008 and 2009,” the CTA said in its resolution issued last week.

“The suspension of collection shall be subject to petitioner’s depositing of a cash bond in the amount of P 3,298,514,894.35 or posting of a GSIS bond or a bond from other reputable surety company duly accredited by the Supreme Court, in the amount equivalent to one and one half (1 ½) of the amount being collected or P 4,947,772,341.53,” the resolution added.

Pacquiao was ordered to post the bond within 10 days from receipt of the resolution.

BIR Commissioner Kim Henares said Pacquiao’s tax case has not been finally resolved so he is not yet out of the woods.

“To stay the garnishment, he has to post a cash bond or a surety bond. I do not see it as stopping the garnishment, as it will only stop if he is able to post the cash bond which is more than P3 billion or a surety bond of more than P4 billion,” Henares told ABS-CBN News.

The BIR had issued warrants of distraint and levy and garnishment on some of Pacquiao’s assets after the boxer reportedly failed to report his income taxes from his fights in 2008 and 2009.

Pacquiao filed an appeal before the CTA, questioning the agency’s action versus his alleged tax liability.

“Our assessment for 2008 and 2009 has a deficiency for income tax and deficiency of VAT. The total, as of Dec. 31, 2012 was P2.2 billion,” Henares said earlier.

Pacquiao has paid P32 million for surcharge and value-added tax

PHILIPPINE NEWS

Pacquiao pays P165 M income tax to BIR as CTA stops garnishment of properties

Archives

- April 2019 (3)

- January 2016 (13)

- December 2015 (13)

- October 2015 (14)

- September 2015 (16)

- August 2015 (15)

- July 2015 (15)

- June 2015 (1)

- May 2015 (15)

- April 2015 (15)

- March 2015 (28)

- February 2015 (1)

- January 2015 (31)

- December 2014 (16)

- November 2014 (16)

- October 2014 (31)

- September 2014 (31)

- August 2014 (36)

- July 2014 (32)

- June 2014 (29)

- May 2014 (28)

- April 2014 (15)

- March 2014 (51)

- February 2014 (30)

- January 2014 (33)

- December 2013 (31)

- November 2013 (31)

- October 2013 (32)

- September 2013 (31)

- August 2013 (30)

- July 2013 (18)

- June 2013 (33)

- May 2013 (33)

- April 2013 (38)

- March 2013 (36)

- February 2013 (35)

- January 2013 (35)

- December 2012 (47)

- November 2012 (36)

- October 2012 (48)

- September 2012 (28)

- August 2012 (38)

- July 2012 (30)

- June 2012 (30)

- May 2012 (31)

- April 2012 (29)

- March 2012 (30)

- February 2012 (30)

- January 2012 (37)

- December 2011 (48)

- November 2011 (23)

- October 2011 (69)

- September 2011 (46)

- August 2011 (30)

- July 2011 (79)

- June 2011 (30)

- May 2011 (66)

- April 2011 (66)

- March 2011 (39)

- February 2011 (67)

- January 2011 (146)

- December 2010 (124)

- November 2010 (122)

- October 2010 (163)

- September 2010 (98)

- August 2010 (101)

- July 2010 (146)

- June 2010 (72)

ShareThis

ShareThis